- Best financial software for day trading tax software#

- Best financial software for day trading tax professional#

- Best financial software for day trading tax free#

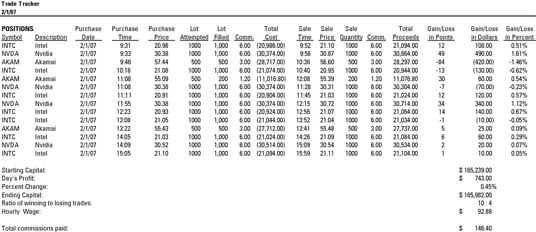

With that longevity comes a stellar track record as an all-in-one cryptocurrency platform that incorporates sophisticated tracking and charting features with versatile tax accounting capabilities in a single package.

Best financial software for day trading tax software#

Still, if you are looking for a straightforward, accessible and versatile option for tracking wallets and generating crypto filings during tax season, CoinTracker is one to keep in mind.ĬoinTracking is one of the more established crypto tax software on the market right now, having launched way back in 2012.

Unfortunately, the options in this regard are somewhat less robust than other platforms, lacking some of the charting and customization tools available from other software. What’s more, users can freely export their transaction and tax data directly into 8949 tax forms as well as to tax prep software TurboTax and TaxAct and even just a CSV file.īacking up these tax filing capabilities is a solid suite of tracking tools, including automated sync with multiple exchanges and wallets and prices for more than 2000 coins. In addition to FIFO and LIFO accounting methods, it also allows for highest in first out (HIFO) and adjusted cost base (ACB) accounting methods. The platform offers packages that start at $49 and a premium version for $500, though CoinTracker also provides customers the option to customize a package to suit their needs.įirst and foremost, CoinTracker is a tax tool and it fills that role extremely well. Nevertheless, Accointing’s tax optimization abilities and intuitive interface make it one of the best cryptocurrency tracking and filing tools on offer.įor those looking for a more specialized tax tool with a few bells and whistles, CoinTracker offers automated tracking across major exchanges and a laudable set of trade analysis and accounting tools. One drawback to Accointng’s filing capabilities is its incompatibility with general tax software like TurboTax. The software also features guided report creations as well as standardized filings for the United States, the United Kingdom, Germany, Austria and Switzerland.

Accointing’s tax software allows users to optimize their filing through automated income calculation along a variety of cost basis methods, including first in first out (FIFO), last in first out (LIFO) and specific lot accounting. Where these tracking features shine is in their implementation alongside Accointing’s reporting tools.

Best financial software for day trading tax free#

Best of all, many of these features are available in the free version of the software and the support team is quick to respond to any questions or provide guidance on how any of the tools work.

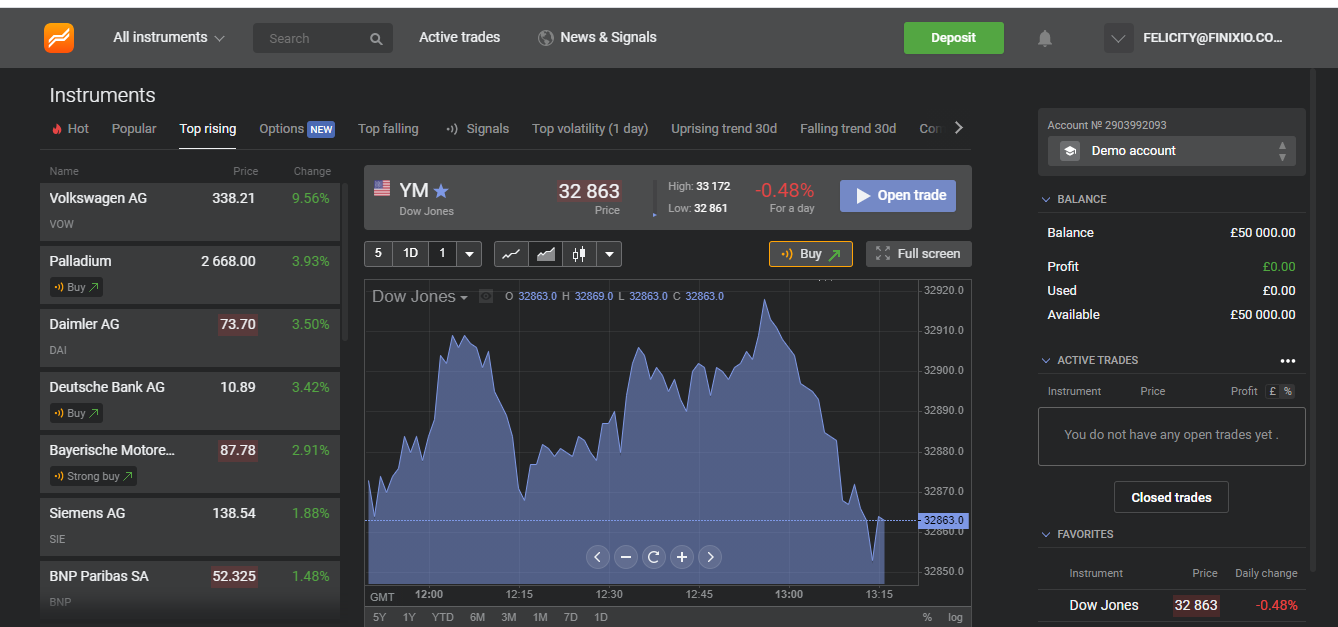

The platform boasts advanced charting tools, account trading metrics as well as a long- and short-term holding period visualizer and calculator.

Best financial software for day trading tax professional#

Accointing offers accounts ranging from free to $259.99 for its professional version, which makes it among the more affordable options of the lot.Īccointing offers some of the most comprehensive cryptocurrency tracking and optimization tools of any option available.

Among the best options for active cryptocurrency traders, Accointing’s automated data import and tracking are compatible with multiple wallets across all major exchanges and sports a user-friendly interface between both its web-based and mobile app versions.

0 kommentar(er)

0 kommentar(er)